OUR PRINCIPLES

Cornerstone believes in core of moral investment can change realties beyond perspectives.

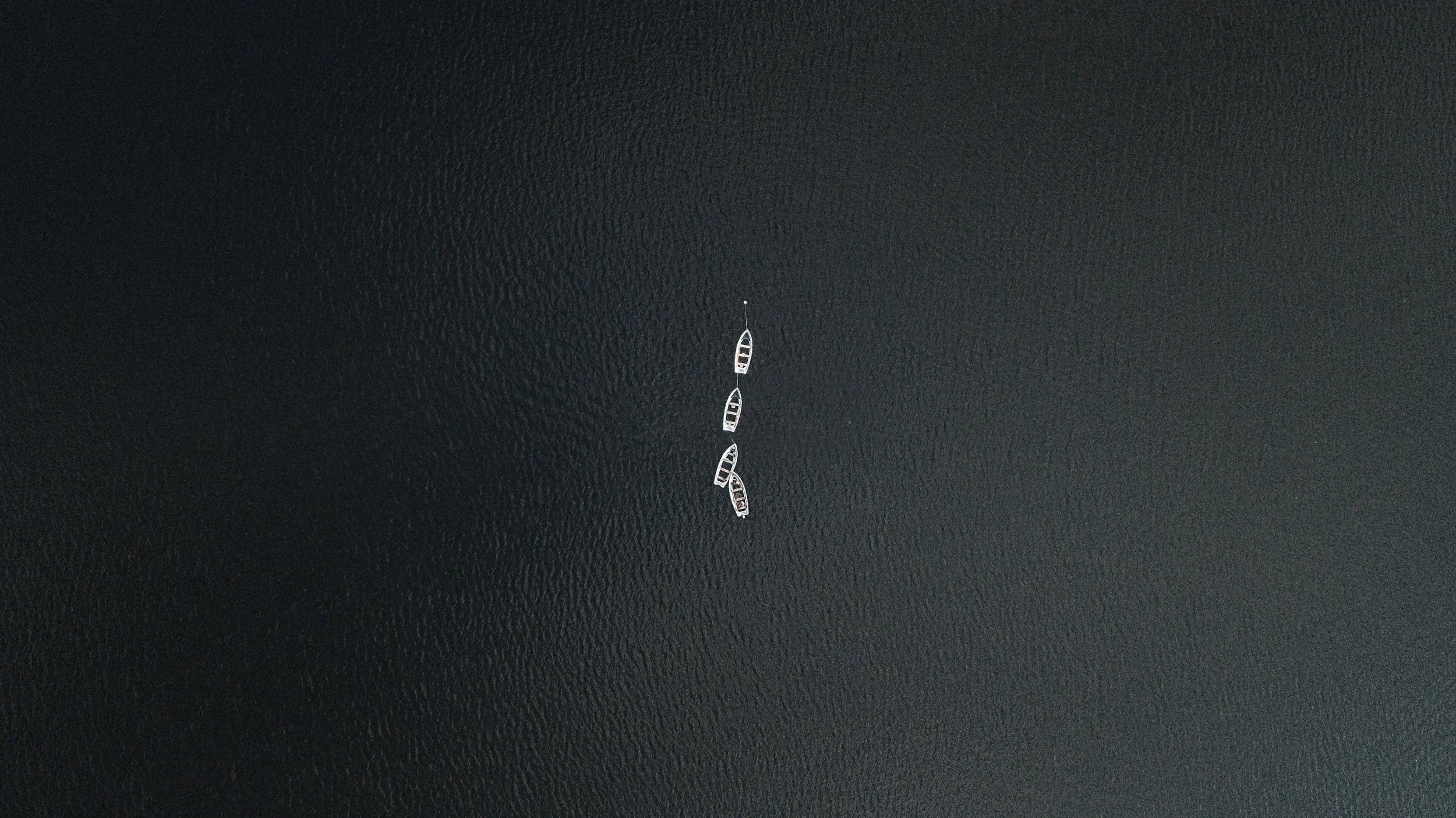

Discretion. We maintain a low public profile and a high standard of confidentiality. Transactions, relationships, and allocations are handled quietly and deliberately. Alignment. The principal’s capital is always first in. Any invited capital participates on the same terms, in the same structures, with the same information. Conviction. We favour a curated set of high-conviction positions, managers, and direct holdings over broad, index-like exposure or product proliferation. Patience. We think in decades and cycles, not quarters. Capital is deployed and withdrawn according to opportunity, risk, and regime – not calendar reporting.

WHAT WE DO

Personal Sovereign Investment Office. CSWC acts as a full investment office for one principal, structuring and managing a multi-asset, multi-jurisdiction portfolio that blends:

Public markets (equities, credit, sovereign & corporate debt)

Private markets (private equity, venture, private credit, secondaries)

Real assets (real estate, infrastructure, strategic real-asset exposures)

The portfolio is managed with institutional-grade risk governance and analysis, but with the agility and confidentiality that only a single-capital structure allows.

Co-Investment & Direct Opportunities (By Invitation)

From time to time, CSWC partners with best-in-class managers, sponsors, and operators to access:

Co-investments alongside leading private equity and real-asset managers

Club deals and structured opportunities typically reserved for institutional capital

Strategic stakes in future-facing sectors anchored in long-term secular themes

On select occasions, trusted partners may be invited to participate alongside the principal on identical terms. The filter is uncompromising: downside protection first, asymmetric upside second, always with the principal’s capital at risk alongside any invited co-investor.

Governance, Structuring & Legacy Capital (Principal-Focused)

CSWC also oversees the capital architecture around the principal’s wealth, including:

Strategic asset allocation frameworks and investment policy guidelines

Coordination with legal, tax, and trust advisers across relevant jurisdictions

Structuring capital for succession, long-term governance, and philanthropic intent

Advisers and counterparties are coordinated around a single centre of gravity: the long-term continuity and sovereignty of the principal’s capital.